Have you ever wondered why businesses need to follow strict rules when reporting their income? Why can’t they just record money whenever they receive it? The way a business reports its earnings can affect its financial health, investor trust, and even legal standing. That’s why ASC 606 is an important accounting rule that generally ensures businesses report their income correctly as well as consistently.

In this blog, we will explain the importance of ASC 606 in revenue recognition accounting and how it benefits businesses in different ways. So, if you want to learn more, keep reading!

What is ASC 606?

ASC 606 is an accounting standard that defines how businesses recognize revenue from contracts with customers. Introduced by the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) it ensures that revenue is recorded when it is earned not necessarily when payment is received.

By following ASC 606, businesses can easily avoid financial discrepancies and ensure that their revenue reporting is accurate and transparent.

Why is ASC 606 Important?

For businesses of all sizes, proper revenue recognition is critical. Here’s why:

- It ensures financial statements reflect the actual earnings of a business.

- It provides a clear picture of a company’s financial health.

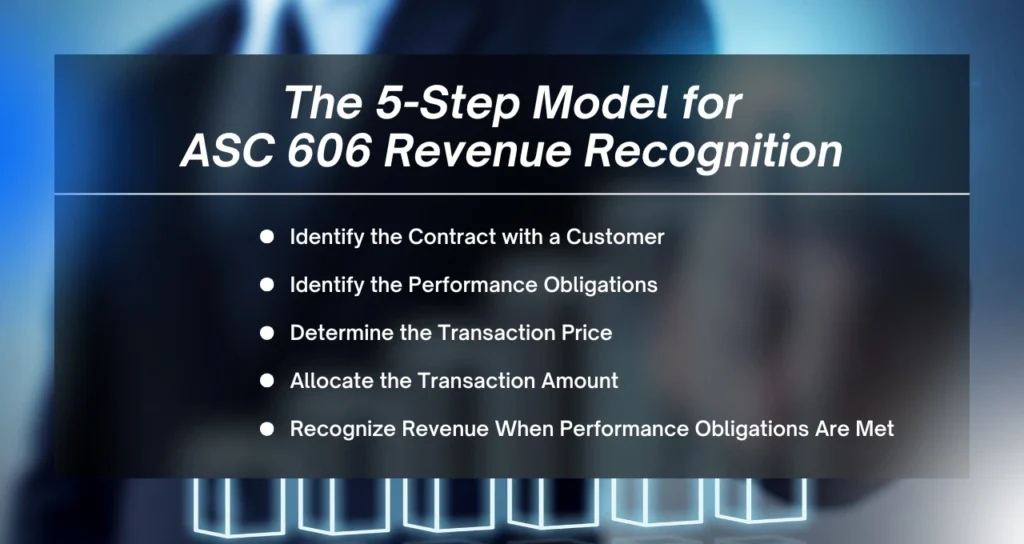

The 5-Step Model for ASC 606 Revenue Recognition

Understanding and applying ASC 606 can be easy if you follow these five steps:

Identify the Contract with a Customer

A contract is an agreement between a business and a customer for goods or services. To meet ASC 606 standards, a contract should include:

- Approval from both the business and the customer.

- A clear outline of goods or services being provided.

- Agreed-upon payment terms.

- Commercial value that impacts the business’s cash flow.

Identify the Performance Obligations

Performance obligations are the promises a business makes to its customers. If a contract includes multiple goods or services each should be treated as a separate performance obligation.

Determine the Transaction Price

The transaction price is the total amount a business expects to receive for fulfilling the contract. This price may include:

- Fixed amounts.

- Discounts or promotional offers.

- Variable pricing based on usage or milestones.

Allocate the Transaction Amount

If a contract includes multiple performance obligations businesses must allocate the transaction price to each obligation based on its value.

For instance, if a contract includes a product and a service bundle, the price must be divided appropriately between both.

Recognize Revenue When Performance Obligations Are Met

Revenue should only be recorded when a business delivers a product or service to the customer. It ensures that financial records accurately reflect when the revenue is earned.

For example:

- If a customer buys a product that ships in four weeks revenue is recognized when the product is delivered.

- If a customer subscribes to a monthly service, revenue is recognized at the end of each month.

Final Words

At Myriad Finance, we understand how important it is for businesses to follow ASC 606 correctly. However, keeping track of revenue the right way can help you stay compliant, attract investors, and make better financial decisions. Our team of experienced ASC 606 accountants is here to guide you through the process ensuring your financial reports are accurate and reliable.

Contact us today to learn how we can simplify your accounting and help your business stay on the right track!